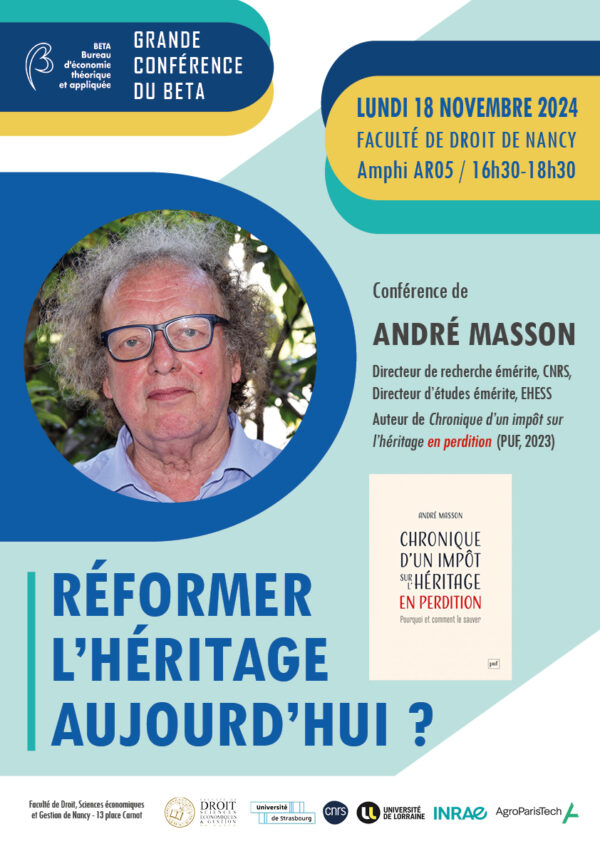

BETA’s major conference – Reforming heritage today? by André Masson

The 2024/11/18

All day

Event details :

André Masson (Emeritus Director of Research, CNRS, Emeritus Director of Studies, EHESS) will be the guest speaker at the next Grande conférence du BETA, to be held on 18 November 2024 at the Faculty of Law, Economics and Management in Nancy.

He will be presenting his work on inheritance taxation, in particular his book Chronique d’un impôt sur l’héritage en perdition (PUF, 2023).

Abstract: Inheritance and its regulation is an eminently ideological subject, involving the right to property, the family and its moral values, and the State as redistributor and investor. A key element in the current debate concerns what might be called the enigma of inheritance tax. Although considered by economic theory to be a good tax, inheritance tax yields very little today, if it has not been abolished (in a number of European countries since 2000). What’s more, they have become very unpopular, in all countries and all social classes. As a result, tax supporters are now faced with a twofold emergency. The first is political and ideological: abolishing inheritance tax would appear to be the simplest and most popular reform. The second, socio-economic, urgency concerns, on the one hand, the unprecedented transfer of inequality that will be generated by the disappearance of the baby-boom generations, who are numerous and well endowed with wealth, and on the other hand, the heavy, productive, ecological and social investments in the future that are required today. The most high-profile inheritance reforms, which seek above all to reduce the inequality of opportunity between potential heirs, do not meet these challenges. My response to these challenges is to use inheritance tax as an incentive mechanism, aimed at shifting the abundant savings of senior households towards long-term investments, if necessary trans-generational (held successively by parents and then children).Without contravening the moral values of families (‘virtuous’ saving for one’s children), such investments could provide large-scale funding for investments in the future.

This conference is free and open to the general public.